Hello

again.

Hello again.

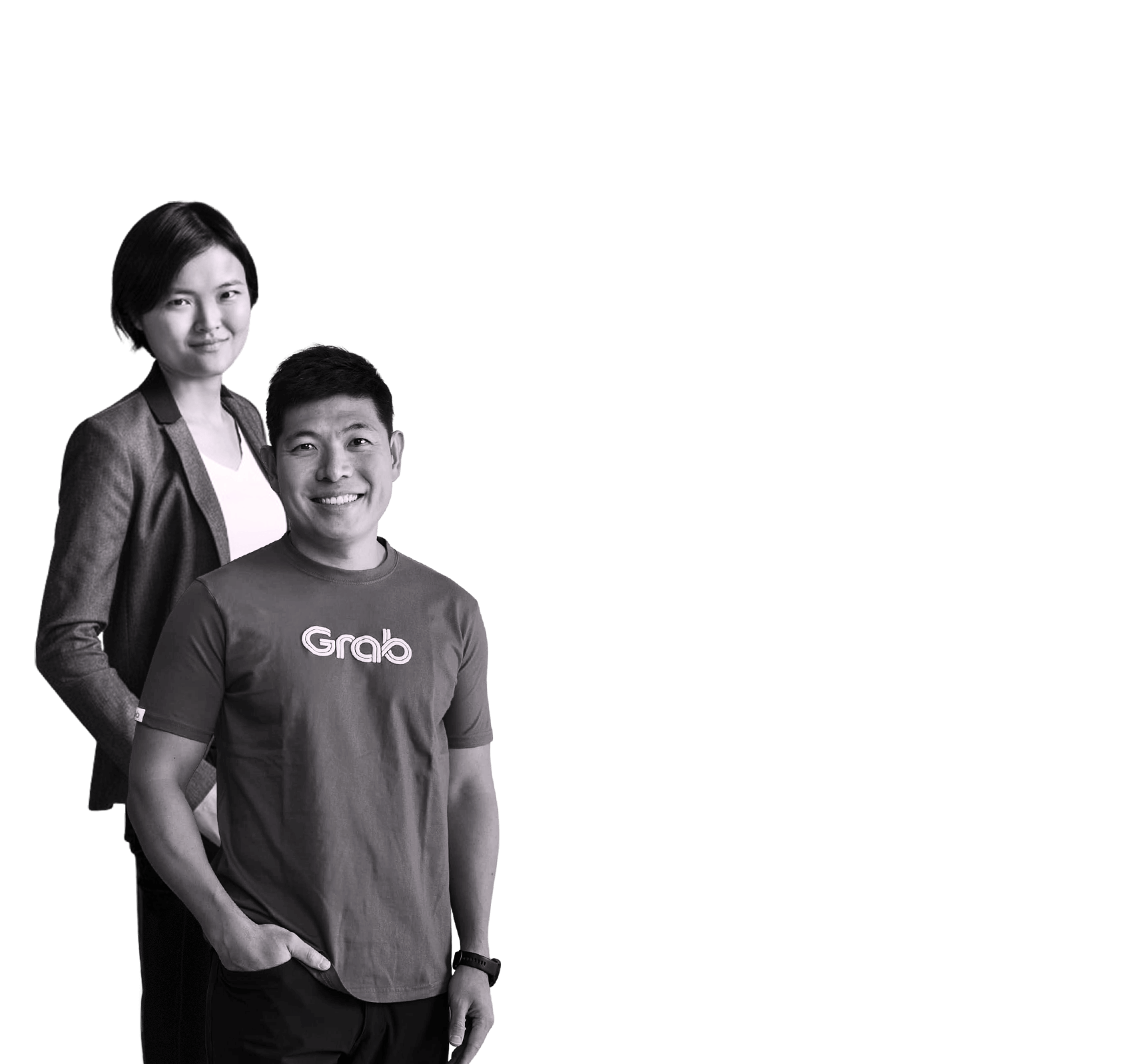

Meet a few of our unicorn founders from

our 2014 investments, as of July 31st

2021.

Left: Hooi Ling Tan and

Anthony Tan of Grab. Top: Achmad Zaky,

Muhamad Fajrin Rasyid and Nugroho

Herucahyono from Bukalapak. Bottom: Eric

Cheng and Jiun Ee Teoh from Carsome.

500 Durians is now

500 Southeast Asia.

7 years ago, investing in Southeast Asia was an acquired taste. 500 Startups began ‘500 Durians’ - dedicated funds to bring attention and investment to founders in this region.

Southeast Asia has since become one of the fastest growing internet economy in the world. A number of our early investments are now home-grown tech giants.

Our work through ‘500 Durians’ has set the stage for our next chapter - ‘500 Southeast Asia’.

This page is both a reflection of our own growth story, as well as a shared vision for the future.

A timeline of 500 in Southeast Asia

For the purposes of this timeline, “500 Southeast Asia” refers to the former 500 Durians family of funds comprising 500 Durians, L.P., 500 Durians II, L.P., 500 Durians Growth Fund I, L.P. and 500 Durians III, L.P. (now known as 500 Southeast Asia III, L.P.).

500's early investments in Southeast Asia make history...

500 Southeast Asia’s portfolio exceeds 100 investments, including Finaccel and other potential champions.

Watch President Obama mention 500 Startups.

Read a related article here.

Invests in more Fintech,

including companies like

Stockbit.

500 Startups

believes that SE Asia isn’t

‘just a bunch of copycats’, and

has real deep tech potential.

Invests in companies like

Transcelestial, Gilmour Space

and more.

Launches founder wellbeing program series.

NOVEMBER

Bukalapak becomes 500 Southeast Asia’s second unicorn.

500 Southeast Asia’s portfolio exceeds 200 companies; new investments include Aerodyne, LottieFiles and Bukukas.

Bonus: 500 Startups launches ImpactAim Indonesia with UNDP to bridge the world of impact investing and tech companies. 9 Series A companies were taught SDG impact measurement, culminating in an impact investment demo day.

Note: ImpactAim Indonesia was operated by 500 Startups Incubator, L.L.C. in partnership with UNDP.

500 Southeast Asia continues investing pace to back new companies in the region.

By mid-year, COVID-19 started to test the resilience of tech companies. While some were affected, many executed pivots, and some even grew.

Most importantly, a number of 500 Southeast Asia portfolio companies strove to be part of the solution, like Zenysis, Gmedes, Kitabisa and many more.

Articles from here.

And the year isn't done yet.

With approximately 15 of our companies in the 500 Southeast Asia portfolio estimated to be valued at more than $100M and racing ahead, we believe it demonstrates the sheer velocity of the region’s growth.

Today...

Reflections on the future of SEA’s startup scene

These views reflect the current investment thesis and strategy of 500 Southeast Asia, and what we believe will be the future growth areas in Southeast Asia.

Derivative of a photo by Victor Garcia, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Sustainable Cities

Cities are the lifeblood of Southeast Asia and will be home to almost 400 million people by 2030.

Can technology transform our cities into environmentally sustainable havens through innovations in energy, transport, waste management, food and agriculture?

Can these cities bring us closer in a safe and empathetic way?

Rural Digitization

The story of cities is only part of the story.

Can we include and uplift the rest of our region and seize the rural technology opportunity?

Can we build solutions that help leapfrog rural development and provide people with the same access and conveniences as cities?

Derivative of a photo by Shutterstock, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Derivative of a photo by nikitabuida at Freepik and a photo at Pxfuel, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Fintech for All

The digital economy depends heavily on financial infrastructure to connect us together. We believe financial technology and embedded finance can usher in a new era of financial inclusion and returns, from smoothing income volatility, access to credit, to insurance that matters.

Can we architect a financial-savvy world where no one is left behind?

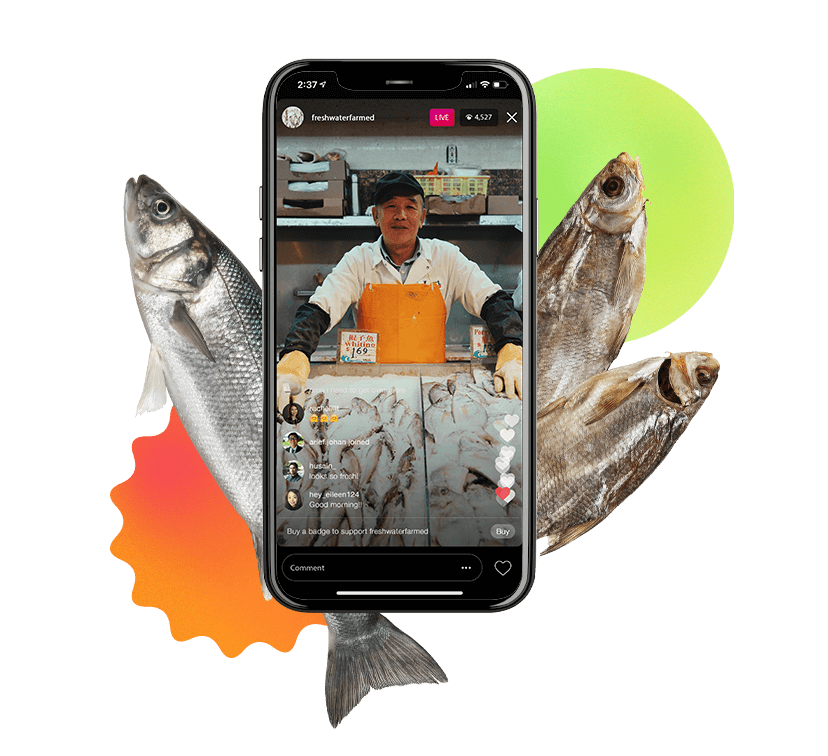

The All-Commerce Ecosystem

e-Commerce of the past decade seems to have expanded into “all-commerce” where consumers demand to buy anything, anywhere (whether online or offline), and have delivered to their doorstep anytime they choose.

What innovations in global trade, logistics, supply chains and trust are needed to make this a reality?

Derivative of a photo by Cami Talpone, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Derivative of a photo by ParallelVision, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Human and Machine Productivity

Technology can profoundly impact a nation’s future through increases in productivity and GDP.

Likewise, we believe competition is also making technology adoption among MSMEs and large enterprises a necessity.

Can ed-tech, machine middleware, low and no-code software solutions, SaaS platforms, and other innovations build more resilient economies?

The Future of Healthcare is Self-Care

We believe healthcare is often overlooked and underinvested, until it is too late. The recent pandemic has underscored the importance of taking care of ourselves.

To us, this “self-care” extends beyond just the body and also into the mind and spirit.

How will technology help us take care of ourselves and each other holistically?

Derivative of a photo by Le Minh Phuong, licensed under CC BY 4.0 by Cassandra at 500 Startups.

Derivative of a photo by Nielsen Ramon, licensed under CC BY 4.0 by Cassandra at 500 Startups.

ESG for Startups

What if every company defines their responsibility to society from the start?

While ESG might not be the first thing on a startup founder’s mind, we want to make that happen by guiding them through their ESG adoption and journey.

In a world that demands responsible tech titans, what better place to get started than with young startups?

Are you investing in the future?

Accredited investors, family offices and institutions are investing in Southeast Asia’s future. Learn more about our suite of solutions.

We build this future with entrepreneurs like you.

Seed Capital

We provide Seed / Series A Capital, up to US$500,000. Idea stage welcome, team, product and traction preferred. We are able to both lead and follow rounds.

Growth Capital

Follow on investments ranging from $500,000 to $5M, and growth stage investments starting at $20M.

Capital Attraction

We help you connect with key industry stakeholders. Our strategic development team works with you on your pitch deck narrative, and taps onto 8 years of co-investor relationships with key VC players globally to kickstart your capital growth plans. It’s a process we’ve refined after investing in over 250 companies.

PR & Content

We help you craft and amplify your story. Our communications team strategizes your branding, content and PR with you, and shares your story with audiences that matter to you.

Training Programs

We help you build resilience in overlooked areas. Training programmes from experts in growth, ESG implementation and monitoring, and founder mental health and wellbeing.

$1.6M of Credits

We equip you with unrivalled resources to extend your runway. Up to $1.6M worth of credits from companies like Microsoft, Google, Amazon, Stripe, Hubspot, Airtable, Salesforce and more may be available from time to time.

Global Community

We build a community to help you succeed. Our exclusive Slack and Whatsapp channels offer opportunities to form direct peer connections to our group of almost 500 Southeast Asian founders, and 5,000 global founders.